What’s The Same And What’s Changed As Air Traffic Surges Back

It seems unbelievable to think that just three years ago—the first year of the 2020s—there were concerns that air travel would not return to the amazing growth trajectory it had seen during previous decades. Yet the latest traffic data from IATA show the post-COVID recovery momentum for passenger markets remains strong.

Total traffic in July 2023 (measured in revenue passenger kilometres or RPKs) rose 26.2% compared to July 2022. Domestic traffic for July 2023 rose 21.5% versus July 2022 and was 8.3% above the July 2019 results. In fact, July 2023 RPKs were the highest ever recorded, strongly supported by surging demand in the China domestic market.

International traffic climbed 29.6% compared to the same month a year ago, with all markets showing robust growth. International RPKs reached 88.7% of July 2019 levels. The passenger load factor for the industry reached 85.7% which is the highest monthly international load factor ever recorded.

Globally, traffic is now at 95.6% of pre-COVID levels, according to IATA, and while some slowing of the recovery momentum is anticipated entering the northern hemisphere winter season, the industry appears in positive health. It’s a very different diagnosis to the one that was predicted by many back in 2020.

There is understandably talk about a return to “normal.” Traffic has rebounded, airlines are feeling more confident to invest in their growth, as large aircraft orders confirm.

Aircraft were fuller than ever in July as people continued to travel in ever greater numbers. Forward ticket sales also indicate that traveler confidence remains high. There is every reason to be optimistic about the continuing recovery and the industry returning to that same growth path from pre-pandemic times.

However, some things are clearly different. Airlines will have to continue to approach how they manage their networks differently. Traveler requirements are different today than at the start of the decade.

Understandably, there has been heavy market substitution in the initial recovery from the pandemic, in part because of different timescales with border reopenings. Leisure flows also recovered faster than business—and question marks remain on the recovery of the latter—and there has been capacity stimulation in specific markets versus more traditional network offers.

Then there is the change in how people do business. A revised structure for corporate travel and the blending of business and leisure itineraries means that historical data on time and length of travel is no longer relevant as travel rules, right down to the times and days of the week people travel, have adjusted.

BUSIEST ROUTES

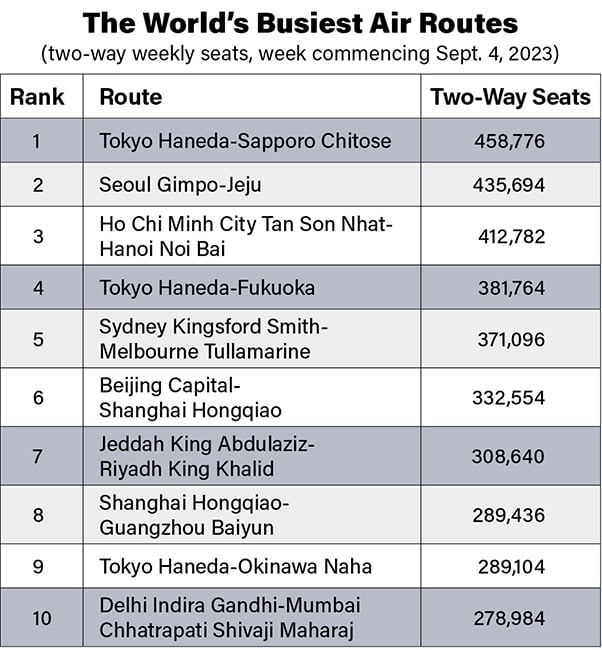

But a look at the world’s busiest air routes show that the Asia-Pacific region dominates (see chart). Despite data showing that Asia has been the slowest market to recover from the pandemic when it comes to international travel, its strong domestic markets rely on air connectivity.

At the start of September, the Asia-Pacific region was home to nine of the top 10 busiest routes, measured by weekly two-way capacity. It was also home to 22 of the top 25 largest global air routes. Not until the top 30 are listed does the first route connecting destinations in Europe and North America appear. That is the London Heathrow-New York John F. Kennedy connection, which was ranked in 2019 as the world’s only billion-dollar airline route.

The top 25 air routes are dominated by the domestic markets; the only exception is Singapore-Kuala Lumpur, which was ranked 20th for the analysis week.

This may all seem very similar to 2019. However, on closer inspection there are some clear differences that illustrate the regional variations that continue to impact the industry’s recovery.

These most obviously include a significant reduction in capacity on the Hong Kong-Taiwan Taoyuan route (-35.2%, moving from 8th to 26th in the ranking) and notable rises in capacity on the Ho Chi Minh City Tan Son Nhat-Hanoi Noi Bai and Jeddah King Abdulaziz International-Riyadh King Khalid International domestic routes in Vietnam and Saudi Arabia, respectively.

What does this all tell us? While air travel is recovering fast, some routes are faring better than others and may be important pointers to future destination growth trends.