This article is published in Air Transport World, part of Aviation Week Intelligence Network (AWIN), and is complimentary through May 03, 2024. For information on becoming an AWIN Member to access more content like this, click here.

Latin American Aviation Faces Opportunities And Challenges

Latin American countries provided limited or no state aid to airlines to offset losses from the COVID-19 pandemic, so it was heartening to see the region’s early recovery, with domestic ASKs surpassing 2019 levels in the latter stages of 2022.

The trend has continued: IATA reported that Latin American airlines posted a 28.6% traffic rise in 2023 over 2022.. Annual capacity climbed 25.4% and load factor increased 2.1 percentage points to 84.7%, the highest among all the world’s regions.

Data from the Latin American and Caribbean Air Transport Association (ALTA) for January to November 2023 show the total number of passengers who traveled to/from the region reached 410.5 million, a 13.9% increase versus the same period in 2022 and, perhaps more importantly, up 3.8% over 2019. In November 2023, Argentina exceeded its 2019 international traffic levels for the first time, while Brazil and Panama also achieved traffic milestones.

Additional industry consolidation and restructuring will further reshape the region’s skies. But some fundamentals remain. Despite traffic growth and strong revenue, the region’s airlines still find it difficult to deliver profitability, and infrastructure constraints, high taxation and government interference will continue to impact activities.

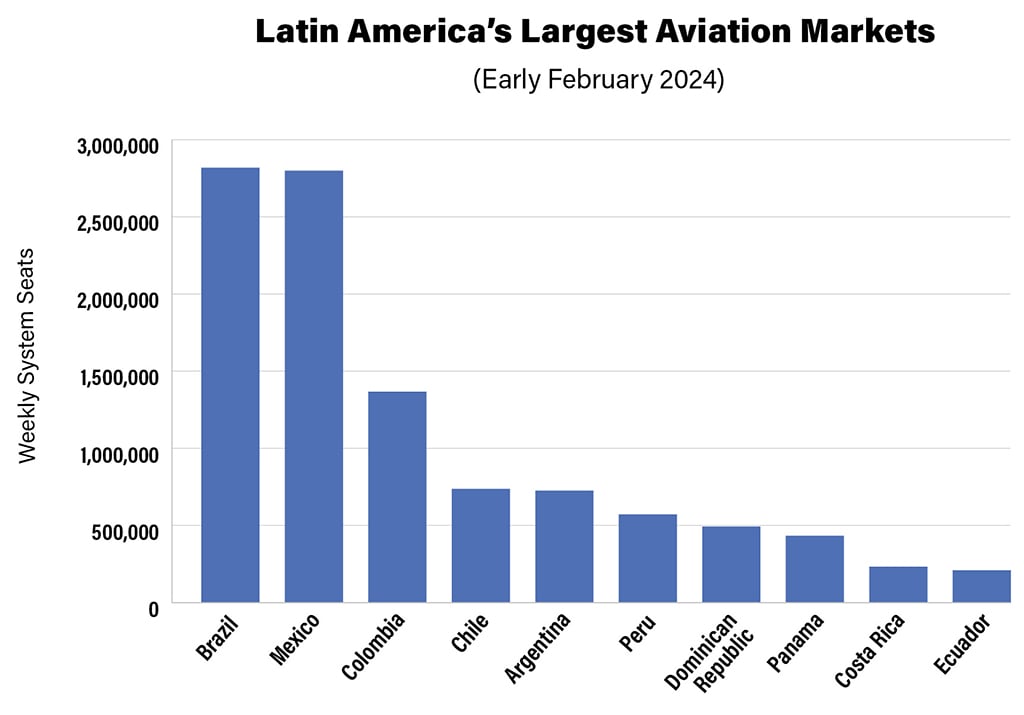

Before the crisis, Latin American airlines struggled to generate profits. The landscape has changed somewhat since then, but that profitability issue remains. While some markets are strong—Mexico, for example—others are facing economic and social turmoil that IATA notes are “negatively impacting airline performance.”

With capacity growth expected to outpace demand growth in 2024, market conditions are “expected to remain challenging,” according to IATA, and the region is expected to remain in the red this year, albeit it while reducing losses.

It was an eventful 2023 in Mexico and 2024 will likely be no different. FAA has finally restored Mexico’s safety oversight grading to Category 1, which allows Mexican airlines to resume growth to the US, but not without sticking points. The US Department of Transportation ordered Delta Air Lines to end its joint venture with Aeromexico, a partnership that has been in place since 2016. Delta blasted the move as “unprecedented, regulatory overreach.”

Overall, however, Mexican airlines are outlining plans for rapid growth in the transborder market, albeit with different approaches. Data from CAPA and OAG show that Mexico’s international ASKs will increase markedly year-over-year through the first half of 2024.

Additionally, Mexico’s government has enlarged its role in the aviation sector throughout 2023, culminating in plans to revive the Mexicana brand. Movement limits at Mexico City International Airport (MEX) will push airlines to bolster their presence at nearby Felipe Ángeles International Airport (NLU), some reluctantly.

The involvement of the Mexican government in the country’s aviation sector has expanded consistently since President Andres Manuel López Obrador took office in 2018 and this will likely continue if his party wins this year’s elections.

RESTRUCTURINGS AND ELECTIONS

In Colombia, two airlines exited the market in 2023, but incumbent airlines quickly moved to fill in the gaps created by the demise of Viva Air and Ultra Air. Colombia’s airlines also face familiar infrastructure constraints at the nation’s largest airport, Bogotá El Dorado International (BOG).

It was not surprising when Brazilian airline GOL entered Chapter 11 bankruptcy protection, reflecting the lingering challenges the region’s airlines face. GOL rival Azul last year completed an out-of-court restructuring after striking deals with aircraft lessors, while the parent of LATAM Airlines Brazil, LATAM Airlines Group, entered Chapter 11 in May 2020.

Aside from some uncertainty regarding the future of Aerolineas Argentinas, GOL’s restructuring should be the last among Latin America’s larger airlines, and the airline understands that it needs to maintain its position in a market where demand continues to remain strong.

Nearly every time a presidential election occurs in Argentina, uncertainty emerges for the country’s aviation sector. Arguably, former President Mauricio Macri’s tenure, which began in 2015, was positive for the industry after he undertook changes that led to the establishment of LCCs in the country.

There was some concern that the previous Fernández de Kirchner administration would wipe out the progress budget airlines had made in the country, but after a minor shakeout in Argentina’s low-cost sector, Flybondi and JetSMART Argentina have continued to grow their presence in the market.

Now, after President Javier Milei’s inauguration in December, declarations have been made over the privatization of some state-run companies in Argentina, including Aerolineas Argentinas, and the adoption of an Open Skies policy. However, it is far from certain that his plans will materialize.

It is clear the aviation sector across Latin America faces both opportunities and challenges in what could prove to be another significant year in the region’s evolution.