This article is published in Air Transport World, part of Aviation Week Intelligence Network (AWIN), and is complimentary through May 05, 2024. For information on becoming an AWIN Member to access more content like this, click here.

EasyJet CEO Johan Lundgren characterized the northern summer 2023 season as “the best ever” financially, helping the European carrier to post a £455 million ($571 million) headline profit for the year to September, recovering from a £178 million loss during the previous 12 months.

The LCC expects capacity to rise by more than 8% during this summer compared to 2019, with bookings at the turn of the year showing an increase in both volume and pricing. Short-haul leisure demand remains strong and customer growth at the group’s vacation business is expected to exceed 35%.

Lundgren admits there has been an element of good fortune contributing to the UK-based airline’s planned summer schedule, given that it has been less affected by aircraft delivery delays and maintenance issues than some counterparts.

“If anything, we’re getting some [aircraft] little bit earlier,” he said. “Ironically, [Airbus] couldn’t fit them with Pratt & Whitney engines because they weren’t there on time, so they got CFM engines. We’re a CFM customer so I think we’re probably the only airline getting aircraft earlier than expected.”

Although conflict in the Middle East dented performance to the tune of £40 million over the winter months after flights to Israel and Jordan were suspended, summer bookings for holiday favorites Portugal and Spain, alongside destinations further afield like Greece, remain brisk. This comes after a year when Portugal and Greece’s markets each outperformed pre-pandemic levels by 12% and Spain by 3%, according to ACI Europe passenger data for 2023.

However, while easyJet is preparing to operate the summer season at full capacity, other European carriers are grappling with a smaller than expected fleet, forcing them to pare back their planned schedules.

Wizz Air is among the airlines that has been most exposed to such headwinds, hampered by the grounding of Airbus A320neo-family aircraft because of Pratt & Whitney PW1100G engine issues. By the start of the summer season at the end of March, the Hungarian ULCC will have about 40 aircraft on the ground, equivalent to almost 20% of its 207-strong fleet.

Although the carrier is working to minimize the impact—by deploying neos to longer sectors, extending existing leases to shore up flying capacity, dry leasing three former aircraft and taking new deliveries—Wizz expects capacity growth during summer 2024 to be flat. This marks a sharp change of pace for a carrier that has been expanding rapidly in recent years.

“Everything is a source of frustration when it comes to Pratt & Whitney—everything,” Wizz CEO József Váradi said when questioned about the neo groundings. “The problem I’m having today is that the markets we are operating require a lot more capacity than what we are able to provide. Today’s operation is already suboptimal versus demand—and we just need to make sure that we catch up on that, and we continue to drive our growth agenda going forward.”

Wizz has committed to retaining all existing aircraft bases despite the groundings, with Váradi insisting the airline needs to have “the bones of the network intact” so it is able “to put more meat on them” in summer 2025 once the engine issues are addressed. This includes reopening a base in Moldova’s capital Chisinau following the restart of flights to the country in December, almost 10 months after suspending service amid safety fears. However, the appetite to launch new routes this summer will be more limited, while there is expected to be double-digit percentage capacity decreases in markets such as Germany, Bulgaria and Greece.

Supply Chain Frustrations

Despite this, Váradi maintains that Wizz has the financial resources and incoming aircraft to kickstart its expansion from summer 2025 onward, estimating capacity could be between 30 to 40% higher. “We’re going to be a lot bigger airline in summer 2025 than what we are operating today,” he added, suggesting that Airbus was better equipped to meet delivery targets compared to Boeing amid ongoing delays to its 737 MAX and 777 programs.

These supply chain challenges delaying MAX deliveries—compounded by Boeing’s manufacturing crisis following the Alaska Airlines MAX 9 door plug blowout in January—have been a source of frustration for Irish ULCC Ryanair in recent months.

After trimming its winter 2023-24 schedule, which included scaling back base operations in Brussels Charleroi and Dublin, the airline has reduced its forthcoming summer plans as it only expects to receive 50 of the 57 MAX 8-200s that it was scheduled to take by the end of June 2024. Passenger numbers for the 2025 fiscal year beginning in April have therefore been revised downwards from 205 million to 200 million.

“We now expect to have up to 174 of these [737 8-200] aircraft in our fleet by the end of June in time for peak summer 2024—that’s up 50 aircraft from summer 2023—but that would still be seven aircraft short of our contracted deliveries due to Boeing delivery delays,” Ryanair Group CEO Michael O’Leary said.

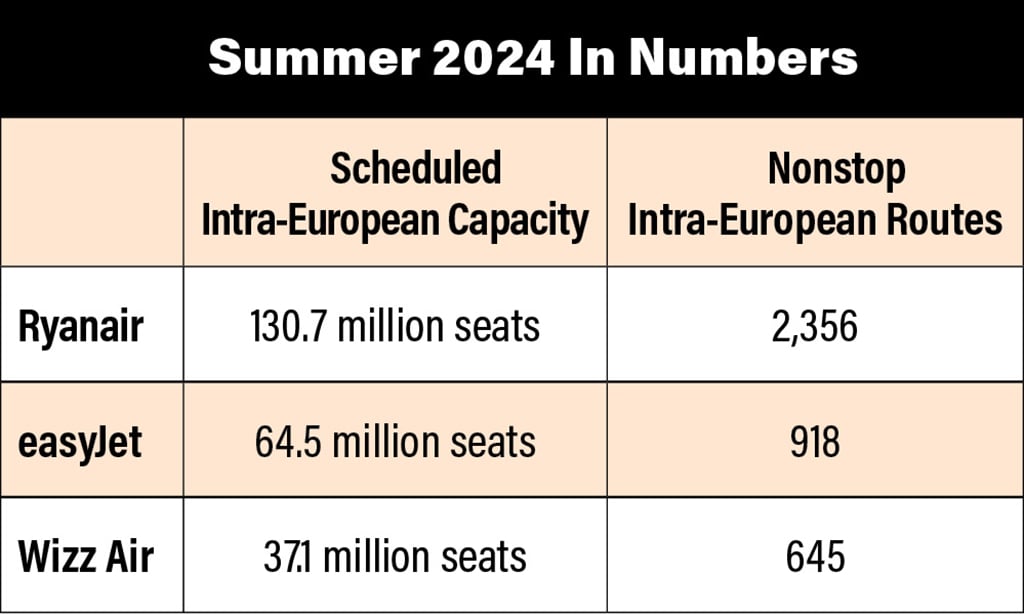

However, the addition of the new aircraft means Ryanair still intends to operate a record summer 2024 schedule, featuring 169 new routes. This includes the launch of domestic flights in Morocco, as well as the first summer services to Albania’s capital, Tirana. OAG data shows that capacity to Greece will be up by 10% year-on-year, Spain by 7%, France by 6% and Italy by 5%.

Although Ryanair’s total summer capacity is scheduled to be more than 7% higher than summer 2023, O’Leary believes that growth within the overall European short-haul market will be flat, owing to the aircraft groundings.

“We expect about 10% of Europe’s A320 fleet to be grounded while they address the Pratt & Whitney engine issues and that this will mean tight supply for summer 2024,” he said.

“Eurocontrol has confirmed that last year European short haul was about 93% of pre-COVID levels. The question for summer 2024 is it going to grow or is it going to decline? We think it’s not going to grow. We are not sure yet whether it declines. It depends on which markets the A320 operators ground aircraft or don’t grow. For example, if you take the likes of Wizz, are they going to constrain their growth in the Middle East or are they going to constrain their growth in Europe? I suspect we are going to see more constraints on growth in Europe where they are struggling to compete with us.”

Analysis of the latest schedules filed with OAG indicate that total intra-European short-haul capacity will climb this summer, but only by about 1%. This means that the number of available seats is likely to remain around 3% lower than during summer 2019 before the pandemic. As such, airlines are preparing for a more constrained capacity environment that, coupled with robust demand, will bring another strong season for ticket prices.

IATA estimated that airfares from and within Europe were about 16% higher in summer 2023, compared with summer 2019, but pointed out that this was four percentage points below the cumulative 20% increase in the European Consumer Price Index over the same period. It added the airfare increase was also lagging rises in fuel prices.

However, the hike is understood to have attracted the attention of the European Commission, which does not have the power to regulate airfares, but is concerned that the rise could damage connectivity. Despite this, carriers like easyJet, Wizz and Ryanair are braced for another period of higher yields as demand continues to outstrip supply.

Analyst JP Morgan increased its easyJet profit-before-tax estimates for 2024 to 2026 by 26%, 20% and 16%, respectively, upgrading the airline from neutral to overweight as it sees it outperforming the sector average. It also maintained its overweight rating on Ryanair, saying it remains the best “structural” story in a commoditized industry, and held its neutral rating on Wizz.

It therefore seems that while capacity will continue to lag demand in Europe’s short-haul sector this summer, demand will continue to be strong, pushing yields higher. Combined with a more benign fuel environment, the region’s largest low-cost operators will likely be among the airlines making hay while the sun shines.