Seeking Relief

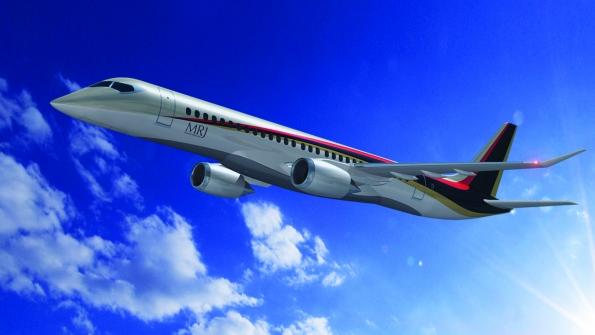

Credit: Mitsubishi

Two of Mitsubishi Aircraft Corp.’s most high-profile orders for the Mitsubishi Regional Jet (MRJ) are with US regional airline operators SkyWest Inc. and Trans States Holdings, but there is a big caveat on the 100 and 50 MRJs, respectively, that SkyWest and Trans States have on their books. Because...

Subscription Required

This content requires a subscription to one of the Aviation Week Intelligence Network (AWIN) bundles.

Schedule a demo today to find out how you can access this content and similar content related to your area of the global aviation industry.

Already an AWIN subscriber? Login

Did you know? Aviation Week has won top honors multiple times in the Jesse H. Neal National Business Journalism Awards, the business-to-business media equivalent of the Pulitzer Prizes.